Expert Source: Rachel Cruze, daughter and colleague of celebrated personal-finance adviser Dave Ramsey, works with banks and credit unions nationwide on finance and debt issues. Her book, Smart Money Smart Kids, coauthored with her dad, was published in 2014.

For many of us, the very word “budget” evokes visions of nasty number crunching and financial deprivation. Making a budget seems like something only a CPA could do — and sticking to it must require the self-denial of a saint.

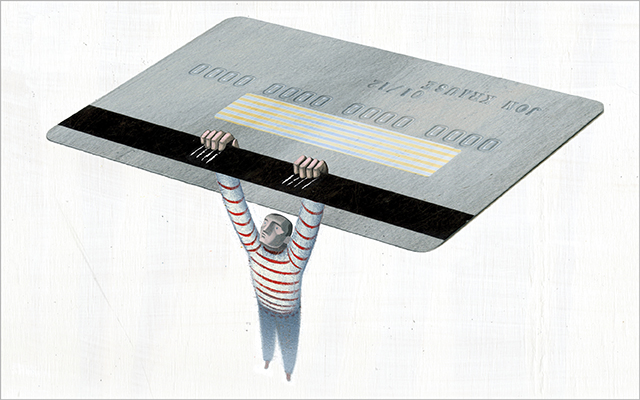

And yet the whirlwind of financial vagueness that many of us live in is even worse: Spending without much sense of how much is really going out. Bills arriving as surprises and getting paid with the fervent hope that there’s enough money to cover them. Worries about the mortgage or car payment that make for sleepless nights. And dreams of having enough cash set aside for a vacation — or a retirement — on permanent hold.

When you add up the stresses of living without a budget, the idea of crunching a few numbers begins to seem worth the trouble.

Personal-finance expert Rachel Cruze travels the country speaking to people about how to get control of their finances. She shares some simple advice to help make household budgeting not only doable, but even pleasurable.

Barriers to Overcome

- Fear of financial reality. “A lot of people are scared of what lives in the bill drawer,” says Cruze. “They’re afraid of what they’re going to find out when they actually take a look at their financial picture — that their situation is desperate.”

- Sense of entitlement. Cruze says that one of the toughest habits to learn when establishing a budget is self-control. “You have to have the maturity to tell yourself no. Many people simply let their money happen to them and don’t worry about how much they spend. Some people simply have a hard time facing the fact that they’re going to have to say no to themselves sometimes to stay on a budget.”

- Specter of boredom. Not only does the prospect of a budget leave some people thinking that they’ll never be able to have fun with money again, but they may also think that budgeting will turn them into dull, pedestrian bean counters.

- Different money styles. When you share a household budget with another person, management can be even trickier. “In my work with couples, I almost always find that opposites attract — one of the pair is a ‘free spirit’ and the other is a ‘nerd.’ The nerd takes care of, or at least worries about, family finances, while the free spirit spends and doesn’t want to be bogged down with a budget.”

- Lack of structure. Cruze points out that it can be easier for people to budget and handle money at work than at home, mainly because in the workplace there’s usually some semblance of accountability — a boss, regular meetings, scheduled reports. Lack of such a structure on the home front can keep money issues from being addressed and resolved.

Strategies for Success

- Prioritize. For Cruze, the first step for budgeting and financial clarity is a mental one — to accept that the process is important, and to make time for it on a regular basis.

- Understand the 80-20 rule. If you’re concerned that getting started and sticking to it might be too hard, Cruze points out that “all our experience shows that budgeting is a lot simpler than people think. It’s really only 20 percent head knowledge and 80 percent behavior. Staying on a budget is a lot more about what you do than what you know.”

- Have a monthly review. “Every month, during the week before the new month begins,” says Cruze, “sit down and establish your budget for the coming month — and write it down.”

- Assign every dollar. “I’m a firm believer in zero-based budgeting,” says Cruze. “Income minus expenses equals zero. You decide, at your budget meeting, on where every dollar you have coming in is going to go in the next month — spending, saving, or giving. Every dollar has a name.”

- Include both money styles. If you are part of a couple, Cruze suggests overcoming the “nerd”/“free spirit” divide by a simple division of labor: Let the nerd prepare a draft of the basic budget and the free spirit make creative suggestions for changing it.

- Use electronic tools. Quicken, or the free site Mint.com, can help you track your budget and reconcile your checkbook or electronic banking record every month.

- Use the “envelope system” in problem areas. Putting cash in designated envelopes can help you stick to your budget in areas where you tend to overspend, says Cruze. Money for eating out, gas, or groceries goes into its envelope for the month, and when that cash is gone, it’s gone. “This is a particularly good tool for ‘free spirits,’” she says.

- Be flexible. “Sometimes people worry that once they set up a budget they’re locked into it,” Cruze says. “The reality is that life is going to happen and situations are going to change. If you have to increase a category and decrease another in the middle of the month, that’s OK as long as the budget balances.”

- Maintain unity. Whatever the budget issue may be, if there’s more than one of you involved, it’s important that both partners participate and work out agreements, says Cruze.

- Use the 90-day principle. “For the most part, after 90 days your budget will work,” Cruze says. “The first three months can be a little crazy as you figure out your spending, but after that, meeting every month will get a lot easier.”

- Celebrate freedom and abundance. “If you stick with budgeting long enough for it to become easier and turn into a habit, you’ll likely get to the point where you feel as if you’ve been given a raise,” says Cruze, “The fears of deprivation and limit you may have had will dissolve because you feel so much freer in this area of your life. Budgeting gives you power.”

More Resources

The One Week Budget

Aliche’s book provides a concise, steby-by-step guide to establishing a workable budget in a short time. See her website to read the first chapter of the book for free: www.thebudgetnista.com

Better Money Habits (www.bettermoneyhabits.com)

This comprehensive personal-finance site is an alliance between Bank of America and online educator Khan Academy. The budgeting page offers a lively video that takes you through the process.

Mint.com (www.mintcom)

A free site that helps you create and stick to a budget — and track your spending, savings, and investments.

Quicken (www.quicken.intuit.com)

This well-known personal-finance software helps budget and track your money.

This Post Has 0 Comments