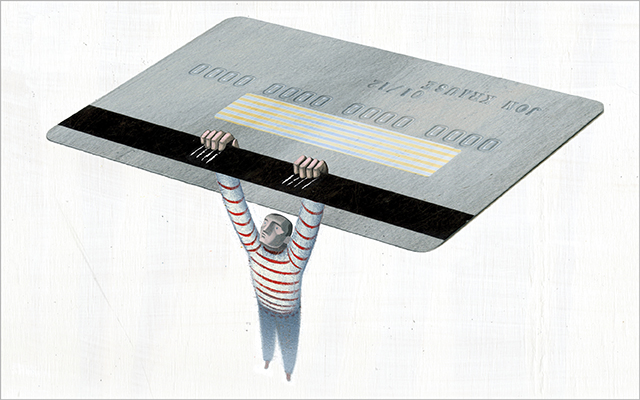

Credit-card spending can be like eating potato chips. You usually feel worse after indulging, but it can be fiendishly difficult to stop. And when there’s nothing else in the cupboard to eat, chips for dinner is sometimes the best option.

As with junk food, the consequences of credit-card spending linger. While payment terms on a student loan or mortgage are generally stable, the debt on credit cards typically comes with fees and ever-compounding interest rates. The hydra-headed nature of these expenses can push card debt out of control even when you’re making faithful payments. Today, when many people feel pressure to use credit just to make ends meet, the average U.S. household credit-card debt is nearly $16,000.

It’s undoubtedly preferable to spend within your means and avoid this kind of debt altogether. But if you’ve fallen on hard times and found yourself unable to get ahead of credit-card bills, there is nonjudgmental help available. We’ve convened three recognized financial experts for advice on the most effective ways to bring this difficult form of debt under control.

Barriers to Overcome

- Denial. A credit card often doesn’t feel like real money, observes Brad Klontz. “A card distances us from the fact that we’re spending,” he says. “We’re not laying 20-dollar bills on the counter, so it’s easier to spend freely.”

- Marketing pressure. Credit-card marketing ensures that just about everyone — from barely independent college students to adults with a long debt history — will be deluged with tempting card offers. These solicitations are designed to make credit-card spending appealing while concealing its more troublesome aspects.

- Shame. “There’s a tendency to judge people with credit-card debt as somehow undisciplined, decadent, out of control,” says Ruth Hayden. “You’re likely to turn this judgment on yourself: ‘What’s wrong with me? I told myself I wasn’t going to use the card again till I’d paid it off.’”

- Emotional spending. One of the chief drivers of credit-card overuse is the impulse buy, says Klontz. Such purchases are often motivated by more existential dissatisfaction. “Advertisers are experts at triggering emotional spending by telling us that buying something will make us happier, more attractive, more satisfied with our lives,” he notes. And to make matters more challenging, with a credit card, you are technically paying for it later.

- The “freeze” factor. The combination of a hefty debt and anxiety of contacting a card company to set up a payment plan makes it seem easier to just put off dealing with a growing balance.

- Credit-score concerns. Chatzky notes that people might hesitate to negotiate a reduced-rate repayment plan with a card company (which is different from a lowered interest rate) out of fear that it may lower their credit scores permanently.

Strategies for Success

- Accept the past. “The main way out of shame for incurring credit-card debt,” says Hayden, “is to simply say to yourself, ‘I incurred the debt; I wish I hadn’t, but I did, and now I’m ready to move on, without self-blame.’”

- Get it on paper. “The first step in facing your debt is simply to write down what you owe, to whom, and what the interest rate is,” advises Chatzky. “This is a small step, but it usually brings some relief immediately.” Hayden agrees: “It’s always safer to know what you owe than to remain in uncertainty.”

- Negotiate reductions. All three experts recommend talking with card issuers to see if you can reduce your interest rates. This may take some persistence, but if your credit score is still in reasonable shape, you should be able to negotiate a better rate.

- Set a percentage for repayment. Reserve a modest percentage of your income for card repayment, and don’t neglect saving, even if the amount is small. Hayden emphasizes that struggling to pay off large sums all at once can push you back into debt when unexpected expenses come up. “Getting ‘rescued’ by large gifts that retire debt can also perpetuate the debt cycle, because you don’t get to feel that you are winning your own victories day by day,” she says. “If you pay off a card slowly and regularly, you really internalize your new financial life.”

- Eliminate balances one by one. Our experts differ on how to prioritize which balance to get rid of first. Chatzky recommends starting with the highest-interest card, while making the minimum payments on the others. Hayden counters that paying off the card with the smallest balance first, regardless of interest rate, gets rid of the balance on your first card more quickly, which provides a priceless psychological boost. This gives you the energy to keep going.

- Be realistic about credit scores. “Many people think that reduced-interest repayment plans will wreck their credit scores forever,” says Chatzky, “but if your score does go down, you can do a lot to repair it in about 24 months.”

- Reconsider your card. Klontz points out that seeing credit-card purchases as the equivalent of bank loans can help keep card use in check. “Renting a car or making hotel reservations — most of these convenient card functions can be performed by debit rather than credit cards,” he says. “If you do use a credit card to buy things you can’t afford, ask yourself before every purchase whether you would be willing to go to a bank and take out a loan to buy the thing in question.”

- Keep cards open. Once you’ve cleared a card’s balance, Hayden recommends you keep the account open. Make a small monthly purchase (she suggests a tank of gas) and pay it off in full immediately. Regularly incurring and settling debt this way improves your credit score.

- Get support. Chatzky and Klontz both underline the value of getting support when dealing with debt. “If you connect with others who have credit-card issues — and you can probably sense who they are among your friends — it can show you that you aren’t alone,” Chatzky says. For additional guidance, Klontz recommends working with a financial therapist. He or she can help you manage your debt and assist you in crafting a more satisfying relationship to money overall. The Financial Therapy Association (www.financialtherapyassociation.org) has a list of qualified therapists. Finally, there are plenty of nonprofits that offer free or low-cost financial counseling. Visit the National Foundation for Credit Counseling (www.nfcc.org), and reward yourself for taking the first steps out of debt by enlisting some additional support.

This Post Has 0 Comments